Understanding Riba-Free Banking

Riba-free banking, also known as Islamic banking, operates on financial principles that align with Islamic financial teachings. The key difference between conventional banking and riba-free banking is the prohibition of riba (interest), which is considered haram (forbidden) in Islam. Instead of charging interest on loans and financial transactions, Islamic banks use profit-sharing models that comply with Shariah law.What is Riba?

In Islamic finance, riba refers to any predetermined, guaranteed increase in capital without corresponding risk or effort. The Quran explicitly prohibits riba in several verses, including: O you who believe, do not eat up the amounts acquired through Riba (interest), doubled, and multiplied. Fear Allah, so that you may be successful. ( Surah Aal-e-Imran 3:130Â ) The Hadith also warns against engaging in riba-based transactions. The Prophet Muhammad (PBUH) condemned both giving and receiving interest, emphasizing the ethical and social harms associated with it.Why is Riba Prohibited in Islam?

Islamic finance promotes fairness, transparency, and social responsibility. The prohibition of riba ensures:- Economic Justice:A Prevents exploitation and wealth concentration.

- Risk Sharing:A Encourages ethical investments where profits and losses are shared.

- Real Economic Activity:A Supports business growth without speculative transactions.

Key Features of Riba-Free Banking

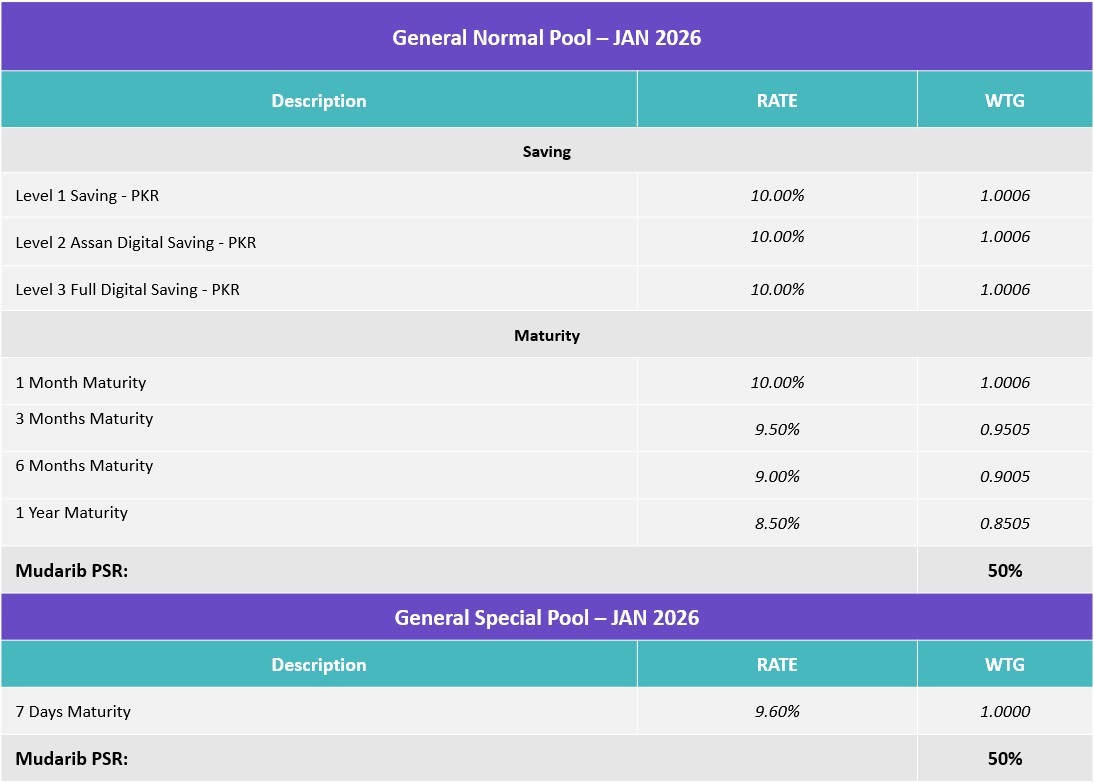

Islamic banks operate under alternative financial contracts to replace conventional interest-based transactions. Some of the most common Shariah-compliant models include:- Mudarabah (Profit-Sharing Agreement):A One party provides capital, while the other provides expertise. Profits are shared based on a pre-agreed ratio.

- Musharakah (Joint Partnership):A Both the bank and the customer contribute capital and share profits/losses.

- Murabaha (Cost-Plus Financing):A The bank purchases an asset and sells it to the customer at a markup/profit instead of charging interest.

- Ijara (Leasing):A The bank buys an asset and leases it to the customer with agreed-upon terms.